Early-Stage Investing Where Longer Lives Reshape Markets.

We back ambitious founders addressing demographic change through practical, scalable innovation. We make early-stage investments where structural change drives persistent demand - informed by a foresight-anchored view of how markets may evolve.

Where Vision Meets Execution.

We invest up to $300k in pre-seed to Series A startups. Pre-revenue companies are considered when there is a clearly defined problem–solution fit and strong domain fit within the founding team. Founders are evaluated on insight, judgment, and execution - not on age, race, gender, education, or prior affiliations.

Select Investments from Our Partners' Track Record

Demographic Change as a Structural Force.

Long-term demographic shifts are reshaping how people work, consume, move, and live. Slower population growth, changing household structures, longer lives, and evolving expectations around work and purpose are altering demand patterns across the economy. These forces are structural, not cyclical. They create sustained opportunities for innovation across healthcare, housing, finance, logistics, workforce makeup, and consumer platforms - well beyond any single age group.

- By 2030, one in six people globally will be over the age of 60, reflecting longer lifespans and changing population structures (United Nations).

- Older consumers control an estimated $4 trillion in annual spending power in the U.S. alone (AARP).

- By 2030, Gen Z is expected to represent roughly 30% of the global workforce, reshaping norms around work, purpose, and wellbeing (Deloitte).

- The working-age population is already shrinking across many advanced economies, tightening labor markets and accelerating automation.

- Across age groups, there is a strong preference for flexibility and continuity in living arrangements, with most wanting to remain independent (AARP).

- The traditional three-stage life - education, work, retirement - is giving way to multi-stage lives.

Together, these shifts point towards an Evergreen Society: an economy organized around longer, more dynamic lives rather than fixed life cycles. Companies that understand and design for this reality are building infrastructure for the decades ahead.

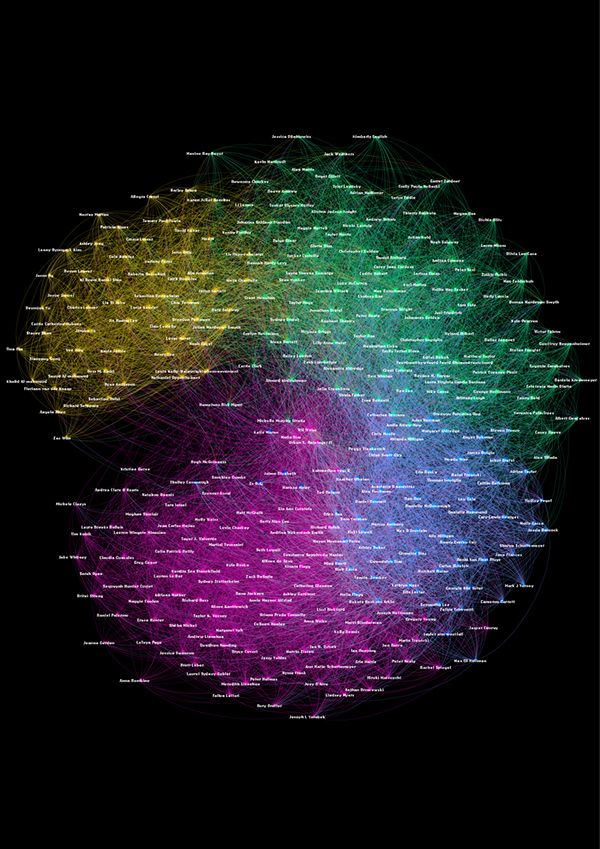

Venture Engine as a Service.

Alongside our fund activity, we selectively extend our investment engine to external partners — what we call Venture Engine as a Service. This gives corporates, family offices, institutional investors, and angel groups access to the same foresight, deal flow, and diligence capabilities we use internally, adapted to their strategic needs.

Foresight Insights

→ Anticipate where structural demand is going. Surface blind spots, map scenarios, and build investment-relevant theses.

Deal Flow Intelligence

→ Curated startup sourcing, structured vetting, and customer discovery support, designed to sharpen your pipeline or validate what’s in it.

Co-Investment Access

→ Join our highest-conviction deals on equal terms, backed by our internal diligence and foresight process.

Examples Where Longer Lives Create Structural Demand.

Scientific wellness & Diagnostics

Health-Adjacent Systems

Stress, Mental Health & Resilience

Finance, Insurance & Long-Life Security

Learning, Re-skilling & Multi-Stage Careers

Autonomy & Meaning Throughout Life

Our team

Our Partners have been building and investing in fast growth ventures for 20+ years

Contact Us.

If you are interested in finding out more about our work, please complete the form below.

.webp)

.jpg)

.webp)